pittsburgh pa local services tax

Offers comprehensive revenue collection services to all Pennsylvania school districts municipalities counties and authorities including current tax and utility fee collection. District PSD Code District Name Tax Collection Agency Website Tax Officer Address.

If the total LST rate enacted is 1000 or less the tax is to be collected in a lump sum.

. Tax rate for nonresidents who work in Pittsburgh. Jordan Tax Service Inc. The pro rata share shall be determined by dividing the.

100s of Top Rated Local Professionals Waiting to Help You Today. Solution The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. Thumbtack - find a trusted and affordable pro in minutes.

Below are examples of two generic LST codes one that is a 10 per year tax and is withheld out of one check and the second is a 52 per year tax and is withheld a little at a time. CITY TREASURER LS-1 TAX 414 GRANT ST PITTSBURGH PA 15219-2476. Act 7 also provides for an upfront exemption when.

Local Services Tax Regulations at httpspittsburghpagovfinancetax-forms. Nonresidents who work in Pittsburgh pay a local income tax of 100 which is 200 lower than the local income tax paid by residents. Landis Jack Company.

City treasurer ls-1 tax 414 grant st pittsburgh pa 15219-2476 A 3000 fee will be assessed for any check returned from the bank for any reason. Total earned income from all sources within Pittsburgh is less than 12000. And comprehensive data accounting banking.

TREASURER CITY OF PITTSBURGH DO NOT SEND CASH Mail to. What happens if you dont pay on time. If the taxpayer believes that the Local Services Tax or the Payroll Tax has been collected by the City in error the taxpayer may seek a refund after the close of the year.

Ad Top-rated pros for any project. Local Services Tax is 5200 per person per year payable quarterly. Fee will be assessed for any check returned from the bank for any reason.

Founded in 1974 W A Gregory Associates serves the general accounting needs of large and small businesses as well as executives professionals and. The Local Services Tax remains a flat 52 tax levied annually on all persons engaging in an occupation within the geographic boundaries of the Borough including self-employed persons. Ad Dave Ramseys tax advisors are redefining what it means to do your taxes right.

Business Privilege Tax at that home office location. 546 Wendel Road Irwin PA 15642. The Local Services Tax LST for cities in Pennsylvania is withheld on a mandatory basis from the salaries of.

RATE OF TAX 52 A person subject to the Local Services Tax shall be assessed a pro rata share of the tax for each payroll period in which the person is engaging in an occupation. To connect with the Governors Center for Local Government Services GCLGS by phone call 8882236837. PA LST Pittsburgh City Heres another example where the description has the space after the letters.

Tax and utility bill printing. Requires that the 52 be deducted evenly from paychecks throughout the year. A worker who is paidweekly would see the tax deducted at the rate of 1 a week.

50 North Seventh Street. This amount applies regardless of the amount of earnings over 12000. If you prefer a refund for 2021 please contact the Finance Department by phone at 412 255-2525 or via email at parkstaxrefundpittsburghpagov.

Any overpayment from the Parks Tax can be applied to your 2022 tax bill if requested. Get a free estimate today. Pennsylvania Act 7 of 2007.

Compare - Message - Hire - Done. For more information see. Location or proof that the employer is remitting Local Services Tax or local municipal tax eg.

Delinquent tax and municipal claim collection. Local Services Tax FAQs at httpspittsburghpagovfinancetax-faqs. CITY OF PITTSBURGH 2022 LOCAL SERVICE TAX EXEMPTION CERTIFICATE.

Tax Return Preparation Payroll Service Taxes-Consultants Representatives. Pennsylvania law limits total payment by one person to a maximum of 5200 per year regardless of the number of employers in a year. Pennsylvania Act 7 of 2007 requires that the 52 be deducted evenly from paychecks throughout the year.

ELK TAX COLLECTION DISTRICT. Residents of Pittsburgh pay a flat city income tax of 300 on earned income in addition to the Pennsylvania income tax and the Federal income tax. X A copy of this application for exemption from the Local Services Tax LST and all necessary supporting documents must be completed and presented to your employer and to the political subdivision levying the Local Services Tax for the municipality or school district in which you are primarily.

The Local Services Tax is 52year collected quarterly. Give less of your money to the government and keep more in your paycheck. What Is Pa Lst Tax.

While someone who is paid bi -weekly would pay 2 every pay.

Welcome To The City Of Pittsburgh City Press Releases

Payroll Services Tax Hr In Pennsylvania Primepay

Court Agreement Could Bring Tax Relief To Allegheny County Homeowners Facing Property Assessment Appeals Pittsburgh Post Gazette

Tax Forms Business Discontinuation Form Local Tax Forms Parking Tax Amusement Tax Quarterly Tax Forms Pittsburghpa Gov

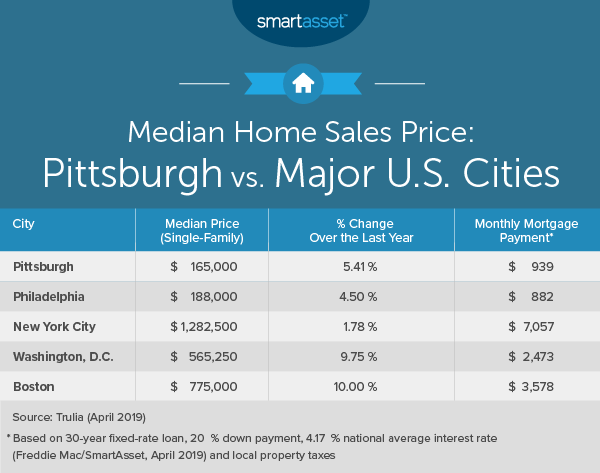

The Cost Of Living In Pittsburgh Smartasset

A Guide To Pennsylvania Property Tax By Jason Cohen Pittsburgh Pittsburgh Pa Patch

Permits Licenses And Inspections Whats Your Permit Status Code Enforcement Condemned Structures Appeals Building Standards And Codes Licenses Information And Fees

Made Movement Logo Brand Strategy Movement Logo Brands

Exterior Of Johnny Garneau S American Style Smorgasbord Restaurant On Business Route 22 In Monroeville Cmoa Collection

Pa Et 1 Pittsburgh 2022 Fill And Sign Printable Template Online Us Legal Forms

City Planning Planning Projects Programs Buildingeye App Zoning Development Gis Department

The Cost Of Living In Pittsburgh Smartasset

Tax Forms Business Discontinuation Form Local Tax Forms Parking Tax Amusement Tax Quarterly Tax Forms Pittsburghpa Gov